Lost Your Insurance or Income Due to COVID-19? Learn About Your Options.

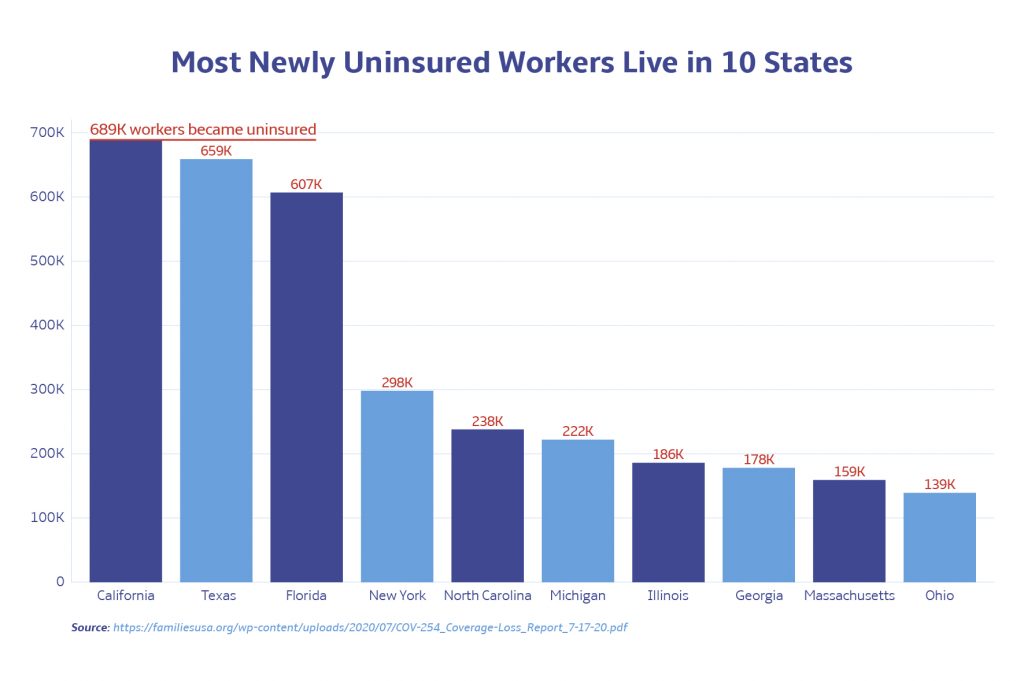

According to a recent report from Families USA, an estimated 5.4 million workers in the U.S. became uninsured due to job loss between February and May[1]. Even before the pandemic, research showed that more than half of Americans with employer-sponsored health insurance had delayed or postponed recommended treatment for themselves or a family member in the previous year because of cost[2]. The loss of jobs, income, and health insurance associated with the pandemic will greatly exacerbate existing health care cost challenges for all Americans.

Because of the pandemic, it is expected that millions of recently uninsured Americans will turn to publicly supported insurance such as Medicaid, the Children’s Health Insurance Program (CHIP), and government-subsidized coverage on the Affordable Care Act (ACA) Marketplaces. Whatever the source for coverage, Americans need to be thinking seriously about ensuring they and their families have quality health insurance for the long term.

Medicaid

Families who have lost income due to job loss should check to see whether they qualify for Medicaid, the national health insurance program for low-income people that’s jointly funded by federal and state governments. Medicaid enrollment takes place year-round and is based on monthly income, not annual income, and it’s essentially free for people who are eligible. Those living in one of the 37 states and D.C.[3] that expanded Medicaid under the Affordable Care Act are more likely to qualify.

ACA Marketplace

Even Americans who don’t qualify for Medicaid but have experienced a loss of household income may still have an opportunity to save on health care coverage. If you are covered through the ACA marketplace, report any changes in household income immediately to see if you qualify for reduced rates.

Some states also run their own insurance marketplaces and have created a special enrollment period during the coronavirus crisis. In these states[4] — including hard-hit places like California and New York — that means you can enroll right now in an ACA plan.

Coverage for Children

Rules for coverage are different for children, so even if you are unable to get a health plan for the adults in your family, you may still get coverage for them. Check out InsureKidsNow.gov to see if your child is eligible for Medicaid or CHIP.

The pandemic has also prompted nearly 2.6 million young adults to move in with their parents since February of this year. For many families, their children were sent home early when colleges closed down, or they moved back in after losing their jobs and health care coverage. Young adults can generally qualify for a special enrollment period due to a change of residence. Children under 26 may be able to be added to existing Marketplace coverage[5].

Learn more about what to look for when selecting a new health care plan during Open Enrollment.

References

- National Center for Coverage Innovation, “The COVID-19 Pandemic and Resulting Economic Crash Have Caused the Greatest Health Insurance Losses in American History”, available at https://familiesusa.org/wp-content/uploads/2020/07/COV-254_Coverage-Loss_Report_7-17-20.pdf.

- The New England Journal of Medicine, “Covid-19 and the Need for Health Care Reform”, available at https://www.nejm.org/doi/full/10.1056/NEJMp2000821

- Kaiser Family Foundation, “Status of State Action on the Medicaid Expansion Decision”, available at https://www.kff.org/health-reform/state-indicator/state-activity-around-expanding-medicaid-under-the-affordable-care-act/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

- ACA Signups, “SEPs”, available at http://acasignups.net/tags/seps

- Healthcare.gov, “Marketplace coverage & Coronavirus”, available at https://www.healthcare.gov/coronavirus/